NBA players earn millions, but taxes take a big bite. So, how much do they really take home?

Understanding how much NBA players make after taxes is crucial. These athletes sign contracts worth millions, but their actual earnings are less after taxes. Federal, state, and local taxes all reduce their income. Different states have different tax rates, affecting players’ net income.

Player salaries also include other deductions like agent fees and union dues. This blog will break down how taxes impact an NBA player’s earnings. We’ll explore how much they actually take home after all deductions. Whether you’re a fan or just curious, read on to learn about the true earnings of NBA stars.

Introduction To Nba Salaries

Understanding NBA salaries can be fascinating. NBA players earn millions, but how much do they keep after taxes? This blog post explores that. Let’s start with an introduction to NBA salaries.

Average Earnings

The average NBA player earns around $7.7 million per year. Star players like LeBron James and Stephen Curry make much more. Their salaries often exceed $30 million annually. These numbers are before taxes and other deductions.

Salary Cap

The NBA has a salary cap. It limits how much teams can spend on player salaries. For the 2022-2023 season, the salary cap is $123.6 million. This cap ensures balance and competition among teams. Teams must manage their budgets wisely to stay within this limit.

Tax Obligations For Nba Players

Tax obligations for NBA players can be quite complex. Their salaries might seem huge, but taxes take a significant chunk. Understanding their tax responsibilities is crucial for players. They need to manage their earnings wisely.

Federal Taxes

NBA players pay federal income tax on their earnings. The tax rate depends on their income bracket. Most players fall into the highest tax bracket. This means they pay around 37% of their income in federal taxes. These taxes fund federal programs and services.

State Taxes

State taxes vary depending on where the player lives and works. Some states have high income taxes, while others have none. California, for instance, has a top rate of 13.3%. States like Texas and Florida have no state income tax. This can make a big difference in a player’s take-home pay.

Players also pay taxes in states where they play games. This is known as the “jock tax.” It means players owe taxes in nearly every state they play. The amount depends on the state’s tax rate and the player’s earnings.

Impact Of Tax Brackets

NBA players earn high salaries. But how much do they keep after taxes? The impact of tax brackets on their earnings is significant. Understanding the progressive tax rates and high-income tax implications is essential.

Progressive Tax Rates

The US tax system uses progressive rates. This means higher earnings lead to higher tax rates. NBA players usually fall into the top tax brackets. These brackets can take a large portion of their income.

Here’s a table showing the 2023 federal tax brackets:

| Income Range | Tax Rate |

|---|---|

| Up to $10,275 | 10% |

| $10,276 to $41,775 | 12% |

| $41,776 to $89,075 | 22% |

| $89,076 to $170,050 | 24% |

| $170,051 to $215,950 | 32% |

| $215,951 to $539,900 | 35% |

| Over $539,900 | 37% |

For example, if a player earns $1 million, they pay 10% on the first $10,275. Then 12% on the next portion, and so on. This results in a high total tax amount.

High-income Tax Implications

High-income earners like NBA players face more taxes. Apart from federal taxes, they also pay state and local taxes. Some states have no income tax, like Florida and Texas. Others, like California and New York, have high rates.

For instance, California has a top rate of 13.3%. This adds a significant burden to player earnings. Consider a player earning $5 million:

- Federal tax: $1.85 million (approx.)

- State tax (if in CA): $665,000

- Net income: $2.485 million

Without state taxes, the player keeps more. The location of a player’s team impacts their take-home pay.

Credit: www.espn.com

Deductions And Write-offs

NBA players may earn millions, but taxes take a big chunk. Understanding deductions and write-offs can help reduce their taxable income. Let’s look at some common deductions for NBA players.

Agent Fees

Players often pay their agents 3-5% of their salary. These fees can be deducted from their taxable income. This helps reduce the overall tax burden. For a player earning $10 million, agent fees could be around $300,000-$500,000. Deducting this amount can make a significant difference.

Living Expenses

NBA players travel frequently and may maintain multiple residences. Costs for housing, travel, and meals can add up. Some of these living expenses are deductible if they are business-related. For instance, a player may deduct the cost of a second home near their team’s location. This helps lower their taxable income.

State-by-state Tax Variations

Understanding how much NBA players make after taxes can be complex. Taxes vary significantly from state to state. This means that where a player lives and plays can greatly impact their take-home pay. Let’s dive into how state taxes can affect NBA players’ salaries.

High-tax States

Some states have high state income taxes. This can take a big chunk out of an NBA player’s salary. For example, California has a state tax rate of 13.3%. New York has a rate of 8.82%. This means players in these states pay more in taxes compared to others.

Here is a table showing high-tax states and their income tax rates:

| State | Income Tax Rate |

|---|---|

| California | 13.3% |

| New York | 8.82% |

| Oregon | 9.9% |

| New Jersey | 10.75% |

Players in these states need to be aware of how much they will lose to taxes. This can affect their financial planning and contract negotiations.

No Income Tax States

Some states have no state income tax. This means players get to keep more of their earnings. Examples include Texas, Florida, and Nevada. This can be very attractive to players.

Here is a list of states with no income tax:

- Texas

- Florida

- Nevada

- Washington

- South Dakota

- Alaska

- Wyoming

Players in these states can save a lot of money. This can make these locations more appealing when choosing where to play.

In summary, state taxes can have a big impact on NBA players’ net income. High-tax states reduce take-home pay, while no income tax states allow players to keep more of their earnings. Understanding these variations is crucial for financial planning.

Credit: fourbrothersfinancial.com

International Players’ Tax Considerations

Playing in the NBA is a dream come true for many international players. But their earnings come with unique tax challenges. These players must navigate both U.S. tax laws and those of their home countries.

Foreign Income Taxes

Many international NBA players must pay taxes in their home countries. These taxes can vary widely. Some countries have high tax rates, while others do not tax foreign income at all. The complexity increases when players have endorsement deals outside the U.S.

For example, a player from France might pay up to 45% in French taxes on their U.S. earnings. This is in addition to the U.S. taxes they already pay. The effective tax rate can be very high.

| Country | Tax Rate on Foreign Income |

|---|---|

| France | 45% |

| Spain | 24% |

| Australia | 32.5% |

Tax Treaties

Tax treaties can help reduce the tax burden for international players. These treaties are agreements between two countries to avoid double taxation. The U.S. has tax treaties with many countries, including Canada, China, and Germany.

For instance, under the U.S.-Canada tax treaty, a Canadian player can get a tax credit for the U.S. taxes paid. This helps lower the overall tax rate. Players need to understand how these treaties work to maximize their earnings.

Here is a simplified list of countries with tax treaties with the U.S.:

- Canada

- China

- Germany

- United Kingdom

By leveraging tax treaties, international players can keep more of their hard-earned money. Understanding these treaties is crucial for financial planning.

Post-tax Income

NBA players often earn huge salaries. But how much do they keep after taxes? Understanding post-tax income helps provide a clearer picture of their finances. Let’s break it down.

Net Salary

NBA salaries vary widely. Top players might earn millions annually. But federal, state, and local taxes reduce this amount significantly. The highest federal tax rate in the U.S. is 37%. State taxes differ by state, with some states having no income tax. Cities with local taxes add another layer of deductions. Players in higher-tax states like California see larger deductions. After these taxes, the net salary can be much lower.

Additional Revenue Streams

NBA players have other income sources. Endorsements are a big part. Brands pay players to promote their products. This income is also subject to taxes. Players also earn from appearances and merchandise sales. They might invest in businesses or real estate. Investment income is taxed differently. Despite taxes, these streams help boost overall earnings.

Credit: news.bloombergtax.com

Financial Planning For Nba Players

NBA players earn substantial salaries, but taxes and expenses can reduce their take-home pay. Effective financial planning is crucial for long-term wealth. Understanding investment strategies and savings plans helps players secure their financial future.

Investment Strategies

Smart investment strategies can ensure a stable financial future. Diversifying investments is key. Players should spread their money across different assets. These include stocks, bonds, real estate, and mutual funds. This helps to minimize risk and maximize returns.

- Stocks: Investing in stocks can offer high returns. It’s important to choose stocks wisely and keep a balanced portfolio.

- Bonds: Bonds are safer than stocks. They provide steady income through interest payments.

- Real Estate: Real estate can be a solid long-term investment. It provides rental income and potential property value appreciation.

- Mutual Funds: Mutual funds pool money from many investors. They offer a diversified investment managed by professionals.

Working with a financial advisor can help players make informed decisions. Advisors provide guidance on the best investment options based on individual goals and risk tolerance.

Savings Plans

Having a solid savings plan is essential. It ensures that players have funds for future needs and emergencies. A good savings plan includes:

- Emergency Fund: Setting aside money for unexpected expenses. This fund should cover at least six months of living expenses.

- Retirement Savings: Contributing to retirement accounts like 401(k)s or IRAs. This helps players save for life after their basketball career.

- Education Savings: Saving for children’s education can be a priority. Plans like 529 savings plans offer tax benefits for education expenses.

- Health Savings: Health Savings Accounts (HSAs) can cover medical expenses. They offer tax benefits and can be a valuable part of a savings plan.

Setting clear financial goals is important. Regularly reviewing and adjusting savings plans ensures they remain on track.

Financial planning is vital for NBA players. Proper investment strategies and savings plans can secure their financial future. This allows them to enjoy their wealth long after their playing days are over.

Real-life Examples

Understanding how much NBA players make after taxes can be tricky. Real-life examples help to see the actual earnings. Let’s look at two categories: high earners and rookie contracts.

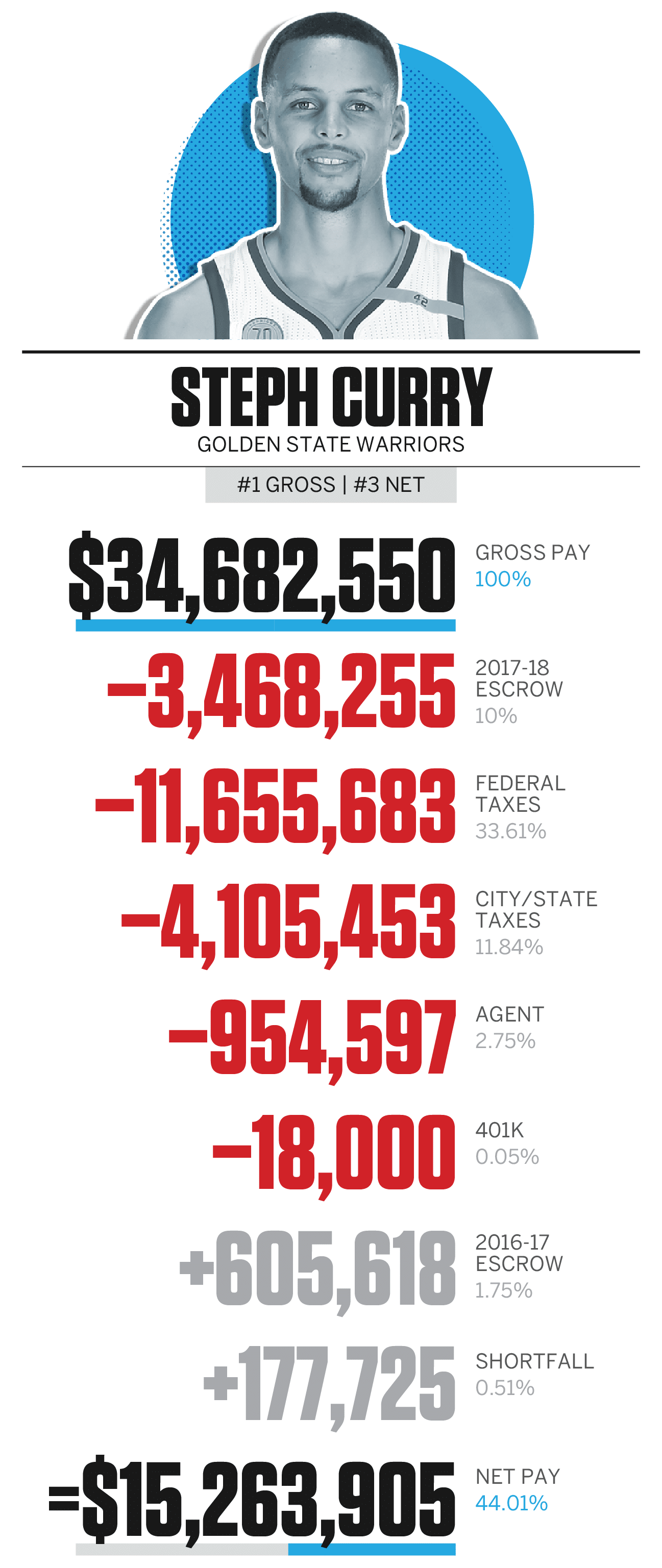

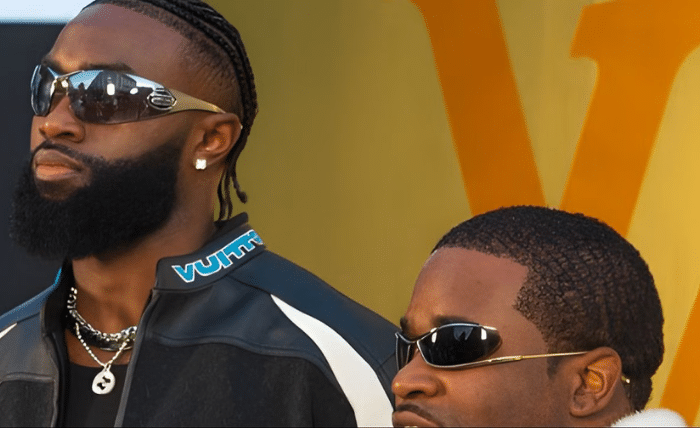

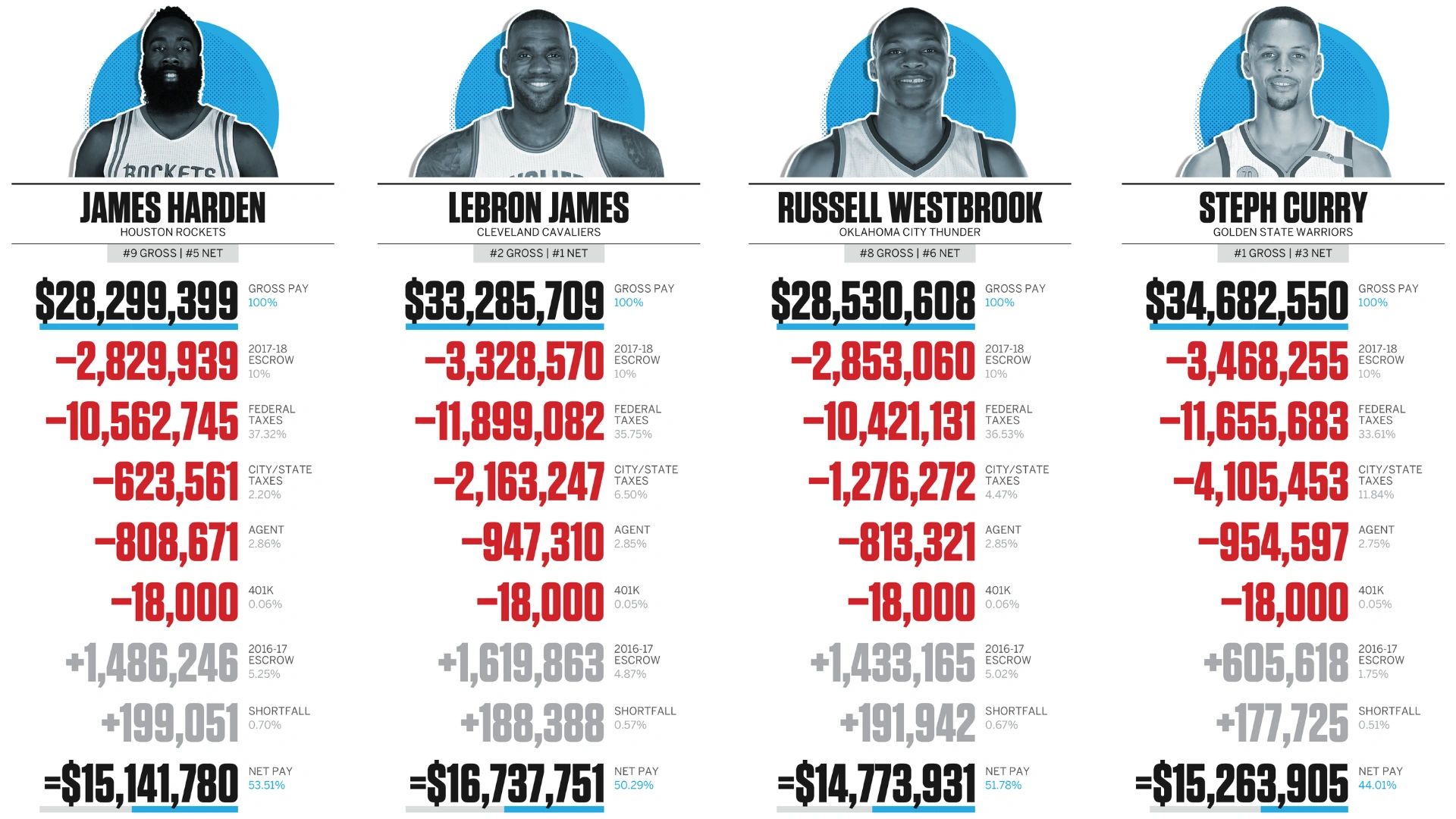

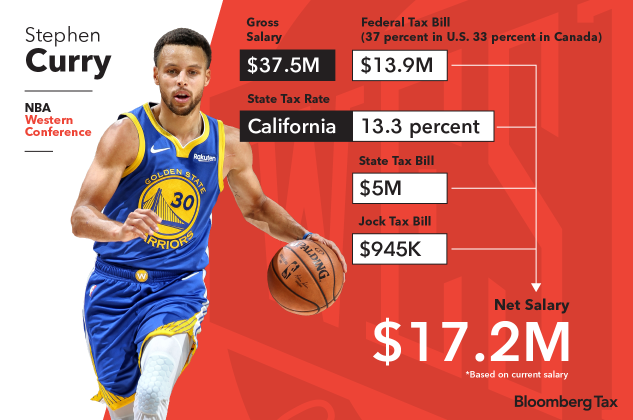

High Earners

High-earning NBA players often have large salaries. But taxes take a big chunk. For example, LeBron James earns around $40 million per year. But, after federal, state, and city taxes, he might take home about $20 million. This means he pays about half of his salary in taxes.

Kevin Durant has a similar story. Earning roughly $42 million per year. After taxes, his take-home pay is about $21 million. These high earners still make a lot. But taxes significantly reduce their income.

Rookie Contracts

Rookie contracts are much smaller. A new player might earn about $1 million per year. After taxes, they take home around $500,000. Taxes impact their income too. But the effect is less dramatic than for high earners.

Consider Zion Williamson, a recent top draft pick. His rookie contract was worth about $10 million over two years. After taxes, he took home around $5 million. Rookies still earn good money. But they also feel the pinch of taxes.

Frequently Asked Questions

How Are Nba Players’ Salaries Taxed?

NBA players’ salaries are taxed based on federal, state, and local tax rates. They often face high tax rates due to their high earnings.

Do Nba Players Pay Taxes In Every State?

Yes, NBA players pay taxes in every state where they play games. This is known as the “jock tax. “

How Much Do Nba Players Lose To Taxes?

NBA players can lose up to 50% of their salary to taxes. This includes federal, state, and local taxes.

Are Nba Players’ Bonuses Taxed?

Yes, NBA players’ bonuses are taxed just like their regular salaries. They are subject to federal and state tax rates.

Conclusion

NBA players’ salaries seem huge, but taxes reduce the amount significantly. After taxes, players take home much less. It’s important to understand the impact of taxes. Salary depends on many factors like state tax rates and endorsements. Proper financial planning is crucial for these athletes.

They must manage their earnings wisely. Keeping track of tax obligations helps them stay financially secure. Understanding these details helps fans see the bigger picture. NBA players work hard and deserve their earnings. But they must also be smart about their finances.